Australia’s equities exodus is finally taking off

Many Australian investors are discovering the benefits from investing offshore.

Australian financial markets are continuing to evolve, and that’s why more and more Australians are finally spreading their investment wings and leaving home.

That’s very apparent based on the increasing investment inflows into exchange traded funds (ETFs), some of which offer exposure to thousands of companies listed on offshore share markets.

They include funds that specifically focus on United States’ shares to ETFs with even broader international exposures to companies listed in dozens of offshore share markets.

U.S. share markets delivered returns of more than 24% over the 12 months to 30 June 2024, compared with the 12.5% total return from the Australian share market. International shares also delivered returns in excess of 20%.

Data released in July by the Australian Securities Exchange (ASX) and Vanguard shows inflows into ASX-listed international equity ETFs totaled $5.28 billion over the first half of this year. That represented 49% of total ETF inflows. Australian equity ETFs attracted $2.95 billion of investor capital over the half, representing 27% of total ETF inflows.

Investors with a strong home country bias may miss out on opportunities in faster-growing or more dynamic economies.

Home bias risks

Home country bias is a common investment phenomenon where investors show a preference for investing in securities in their own markets over international ones. While it might feel safer to invest in familiar territory, this bias can pose risks to portfolios.

In this context, it shouldn’t be surprising that more Australians are heading to overseas markets.

It’s not that the Australian share market is not the place to be. Far from it. There are many great Australian companies that over decades have provided strong returns to shareholders.

Think of the many household names and company brands operating across a broad range of sectors that we all come across every day that are listed on the Australian Securities Exchange (ASX). The ASX is a vibrant market, housing thousands of listed companies.

Yet, there are equally thousands of household names and company brands overseas that have a global reach, some operating in sectors that simply don’t exist in Australia.

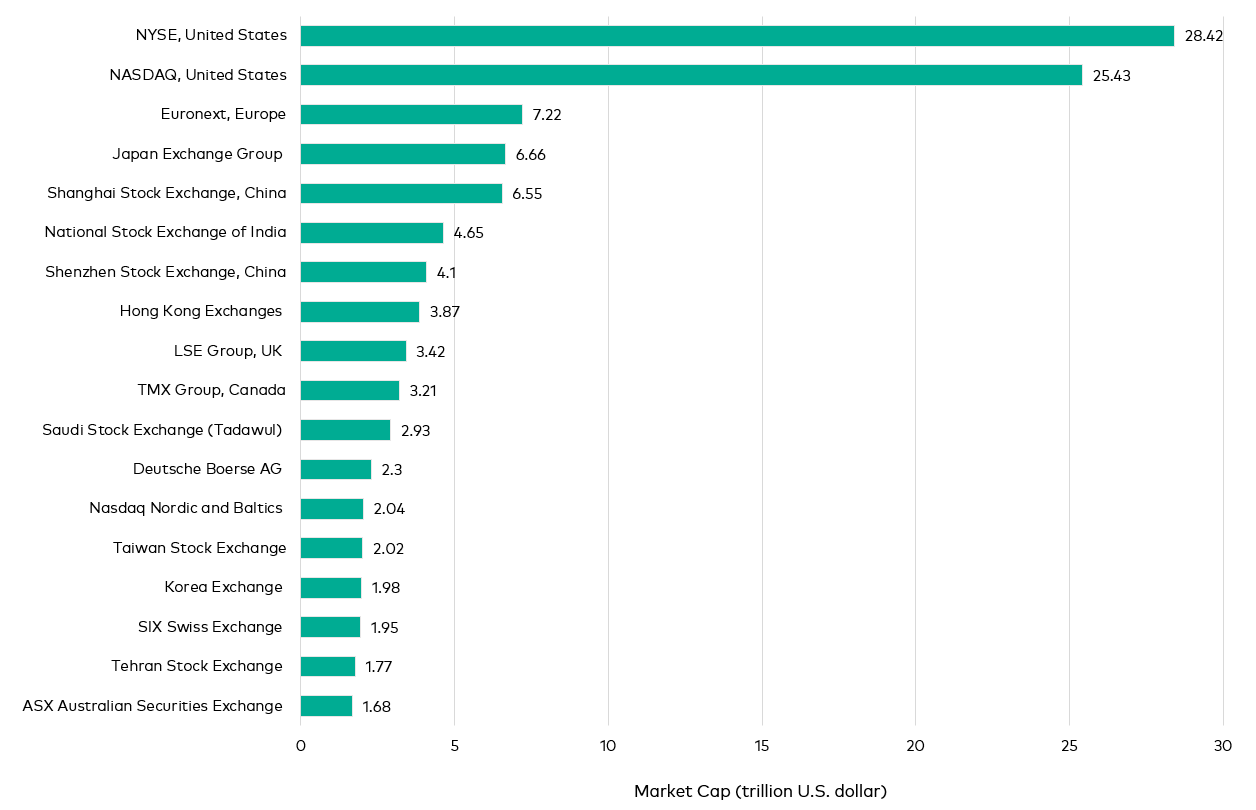

The chart below put things into perspective. On a global scale, the Australian share market is relatively small. Which is fundamentally why more Australians, as well as investing here, are also heading to bigger financial pastures offshore.

Largest stock exchange operators worldwide

Source: Statistica. Data as at 31 March, 2024.

Below are some of the key risks for investors who opt to invest solely in their home market.

- Limited diversification: By concentrating investments in a single country, investors are more vulnerable to the economic fluctuations and political instabilities of that country. International investments can provide a buffer, as different markets often perform differently under the same economic conditions.

- Missed opportunities: Investors with a strong home country bias may miss out on opportunities in faster-growing or more dynamic economies. By ignoring these opportunities, investors can limit their potential returns. Additionally, certain sectors or industries may be more developed or innovative in other countries, providing unique investment opportunities not available in the home market.

- Currency risks: Investing predominantly in one’s home country can also expose an investor to currency risks. If the domestic currency weakens, it can affect the purchasing power and reduce the overall returns when converted to a global standard. Conversely, by diversifying investments across different currencies, investors can offset some of this risk, as gains in one currency might offset losses in another.

- Market size and concentration: Many countries, especially smaller or developing ones, have markets that are not only smaller but also concentrated in a few sectors. Investors with home country bias in such markets face a high concentration risk, where a significant portion of their investment is tied up in a few large companies or a single sector. This can be risky if these sectors face downturns due to industry-specific risks.

- Compliance and regulatory risks: Investors focusing solely on domestic markets might also be less aware of international regulatory changes that could impact their investments indirectly. Global economic policies, trade agreements, and foreign regulations can all influence domestic markets. By not participating in international markets, investors may also miss out on the chance to take advantage of favourable regulatory environments abroad.

- Overconfidence: Home country bias often stems from overconfidence in one’s understanding of the local market. This overconfidence can lead to poor investment decisions, as the investor might underestimate risks or overestimate opportunities in the domestic market. A more balanced view, considering both domestic and international options, can lead to better-informed investment decisions.

While investing in familiar domestic markets might seem less daunting, the risks associated with home country bias can significantly impact the performance and security of an investment portfolio. Understanding and addressing these risks can enhance your chances of achieving a stable and profitable investment outcome.

Consulting with a financial adviser who understands global markets can provide insights and help in building a diversified investment portfolio.

Important Information

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing GENERAL ADVICE WARNING Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”). We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions. Important Legal Notice – Offer not to persons outside Australia The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws. © 2024 Vanguard Investments Australia Ltd. All rights reserved.

GENERAL ADVICE WARNING Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”). We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions. Important Legal Notice – Offer not to persons outside Australia The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws. © 2024 Vanguard Investments Australia Ltd. All rights reserved.